Bildnachweis: Pexels, VC Magazin, Pixabay.

The biotech sector is powering a strong first half year for the Swiss venture capital market. With CHF 705 million in invested capital, the sector reached a new record – despite a decline in the number of deals. International capital and experienced founding teams are fuelling the momentum.

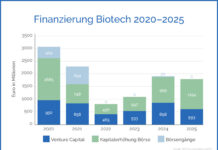

Swiss biotech start-ups raised a total of CHF 705 million in the first half of 2025 – more than ever before in a six-month period. The previous high, set in 2021, stood at CHF 436 million and has now been clearly surpassed. While deal activity declined across the Swiss market overall, biotech dominated the upper end of the ranking, securing seven of the ten largest financings, as shown by the half-year figures from startupticker.ch and the investor association SECA, in cooperation with startup.ch. Five of the seven largest biotech financings occurred at the early stage. Start-ups such as Windward Bio (CHF 183 million), GlycoEra (CHF 108 million) and CeQur (CHF 109 million) exemplify this trend. A striking feature of the Swiss start-up scene, particularly in biotech, is the strong involvement of foreign investors: around 50% of biotech capital came from the US alone, with at least one American venture capital firm participating in nine of the 17 biotech deals. Despite these high volumes, access to funding remains selective. The number of biotech deals declined year-on-year, indicating a growing caution among investors. Backing is focused on start-ups with clinical-stage assets, seasoned teams, and a clear path to exit.

Basel sets new benchmarks

The regional focus of the biotech boom is also evident: the canton of Basel-Stadt reached a new record with CHF 420.5 million – accounting for roughly one-third of all venture capital invested in Switzerland. Basel even overtook Zurich in terms of total investment volume. Nevertheless, Zurich also saw a substantial rise of over 80% in invested capital, driven not only by biotech companies but also by those in ICT and fintech. However, when it comes to deal count, Zurich was the only major start-up hub to register a significant drop – from 60 to 49 rounds.

Conclusion

The first half of 2025 confirms that Swiss biotech is internationally competitive – both scientifically and financially. Early-stage companies with substance continue to attract capital, even in a cautious market environment. Switzerland remains a key biotech hub in Europe.