Bildnachweis: © SAVCA, © SAVCA Survey.

South Africa is establishing itself as a venture capital location. In this interview, Tanya van Lill from the South African Venture Capital and Private Equity Association (SAVCA) reports on developments on the ground and what trends she sees in the market.

VC Magazin: How would you describe the South African financing landscape?

Van Lill: There are various financing mechanisms available in South Africa, given the country’s sophisticated financial system. However, when one tracks the life stages of a company, there are gaps within the financing landscape. Some of the financing instruments available to entrepreneurs include grant funding (through specific government incentives), debt funding (traditionally a bank loan but there are other sources of debt funding available) and equity funding (either self and/or others). However, the funding gaps in the South African landscape tend to be for the seed and early stages phases of an entrepreneur’s new venture and financing the growth of a business beyond Series A. During the very early stages of the lifecycle (seed and early stage), there is very little funding instruments available to get an idea from concept to prototype or production. During these phases, some of the funding available could be a government grant (incentive) where there is alignment between the entrepreneur’s venture and the incentive. And potentially angel funding with a growing angel community prevalent in South Africa. However, most entrepreneurs have to self-fund this part of the business lifecycle. As the business starts to take off and has established proof of concept and starts to generate revenue, venture capital funding starts to become available. However, in South Africa, the venture capital industry is still nascent and is not as mature/established as the private equity sector. Most of the VC funds in South Africa invest in Series A funding, with a few starting to invest in Series B funding. Because the VC industry in South Africa is still growing, there aren’t enough VC fund managers with big enough funds to invest in multiple funding rounds and support the exponential growth experienced by some entrepreneurs. The entrepreneurs and their investors are then compelled to source funding elsewhere (offshore) or prematurely have to sell the business to potential buyers to support the growth trajectory.

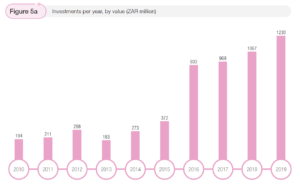

VC Magazin: How would you describe the range of investments over the past year? What are the average investment amounts over the last five years?

Van Lill: The industry experienced exponential growth from 2016 onwards given a change to a tax incentive that saw increased funding into VC companies/firms. On average, the investment amounts tend to be in the region of R8m – R12m. However, some investors are able to invest R20m – R50m, depending on the size of the VC fund and the start-up or scale-up they’re investing into.

VC Magazin: Which industries are predominantly financed with venture capital in South Africa, what trends do you see?

Van Lill: Although VC invests across a spectrum of industries and there are instances where a VC would invest in the manufacturing and distribution of a new product, such as a health drink or in the delivery of products (logistics), most of the investment activity tends to be tech/software- related.

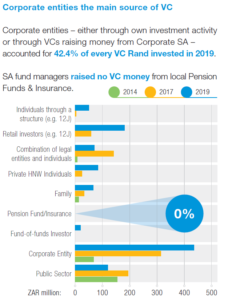

VC Magazin: From which countries are the international investors present in the South African market and what is their respective share?

Van Lill: International investors tend to be from the US and includes some European investors. However, the majority of the VC market share in South Africa is still very much local VC fund managers. From a fundraising perspective, besides for the SA SME Fund which is a fund-of-fund, there is hardly any other institutional capital that is flowing into VC other than corporate VC. Most South African VC firms raise funds from corporates, family offices and high-nett worth individuals. Only recently have we seen other types of institutional capital flowing to established VC firms (DFI’s and pension funds). The VC industry in South Africa is still growing and as it matures, we should see more institutional capital flowing to the industry.

VC Magazin: How is South Africa positioned from a regulatory perspective for venture capital? Are there hurdles for venture capital companies to invest in South African start-ups?

Van Lill: South Africa’s nascent VC industry is growing at a steady pace and the regulatory and legal landscape continues to evolve with the industry. Although there aren’t necessarily regulatory hurdles for local venture capital companies to invest in South African start-ups, international investors into South Africa may be unfamiliar or weary of the requirement of SA’s exchange control regulations, which are not typical in majority of international jurisdictions. These regulations can sometimes create uncertainty and timing delays as a result of regulatory approval requirements for SA start-up’s looking to raise international capital or expand into international markets. As part of SAVCA’s advocacy role we are constantly working with the local regulators and policy makers to ensure that we cultivate a supportive regulatory environment that is entrepreneurial and investment friendly.

About Tanya van Lill:

Tanya van Lill joined SAVCA in March 2017, after a rewarding 10-year career at the Gordon Institute of Business Science (GIBS) with her last role being Director of Academic Programmes where she also served on the board of the Executive MBA Council (EMBAC), an international academic association that represents the Executive MBA industry. More about the SAVCA suvey: click here.