Bildnachweis: Nasdaq Stockholm, Angelini Ventures, TVM Capital Life Science, FCF, NRW.Bank, FCF Fox Corporate Finance, FCF, VC Magazin, Pixabay.

Telling a catchy equity story and starting to address different investor groups at an early company development stage – how European life sciences companies can best these elements to secure long-term financing in a difficult market environment.

For Nuclidium, it is the first financing round with institutional investors – and a quite large one as the Basel- and Munich-based company raised CHF 79 million (EUR 84 million) in July in a series B round. Four international venture capital companies and six regional investment companies formed a broadly diversified consortium of European investors. The base for that remarkable success: the company, which was founded in 2020, had established a technology platform that aims to differentiate itself globally with copper isotopes for the development of radiotheranostics to effectively diagnose and treat cancer. ‘Nuclidium managed to gain visibility in the highly competitive market for radiopharmaceuticals,’ says Regina Hodits, managing partner at Angelini Ventures. According to Hodits, the company achieved an important milestone within an impressively short period: ‘A team of less than ten people succeeded in transforming an exciting idea in

the field of precision medicine from the concept stage to clinical development within three years with financial resources in the amount of EUR 15 million. In order to test the clinical differentiation of the approach, the company now needs a larger volume of funding, which the current series B round provides.’ There is no doubt that without the possibility of setting up a European syndicate, a financing round on such a scale would have become difficult. Locally oriented German development companies such as Bayern Kapital, NRW.Bank and the DeepTech & Climate Fonds (DTCF) are involved, as are the international venture capital companies Kurma Growth Opportunities Fund, Angelini Ventures, Wellington Partners and Neva SGR as consortium leaders. For the life sciences industry, the Nuclidium case is a clear indication that large European syndicates are capable of forming a broad investor base when companies address an unmet medical need.

More than a silver lining

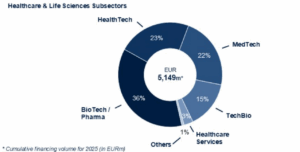

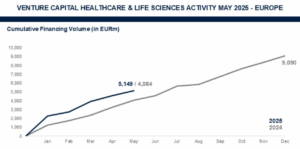

For the European life sciences sector, the Nuclidium transaction could be the starting point for more major deals, as the financing of European life sciences companies by venture capital has been improving significantly, even compared to their US counterparts. This is also the conclusion drawn by the latest Healthcare & Life Sciences Venture Capital Monitor, a monthly publication by FCF Fox Corporate Finance. According to the surveys conducted by the Munich-based financing specialist, who advises public and private scale-ups and mid-market companies all over Europe, the European healthcare and life sciences venture capital financing volume in the period from January to May 2025 has increased by 26.2% versus 2024 – from EUR 4.08 billion to EUR 5.15 billion. 35% of the investment volume is attributable to the biotech and pharmaceutical sectors, 23% to the healthtech sector with its digital technologies for healthcare and 22% to medical technology.

The problem: Money for later stages of development

It’s nothing new that the European life sciences industry has outstanding basic research, especially in universities and state researchinstitutions. Moreover, thanks to a widespread early-stage funding network, the companies also have good access to seed financing. ‘In some areas, the early-stage financing options are on par with the USA and Asia,’ says Mathias Klozenbücher, Managing Director of Life Science at FCF Fox Corporate Finance. In the subsequent financing phases, however, Europe soon falls behind. ‘The US are still far ahead of us in their ability to quickly provide start-ups and more developed companies with sufficient fresh money,’ says Dr Thomas Raueiser, Head of the Life Sciences & Cleantech team at NRW.Bank, aptly describing the dilemma. In terms of invested volumes, the US market for venture capital in the life sciences sector is around four times as large as in Europe. ‘As a result, companies usually get an investment more quickly in the US often associated with larger ticket sizes. Especially in the German speaking countries, there is a lack of life sciences venture capital investors with deep pockets. This makes it particularly difficult to raise money for ticket sizes between EUR 10 million and 50 million,’ explains Klozenbücher. ‘Although we have seen a relatively steep decline in venture capital financing volume in healthcare and life sciences in the US since the beginning of President Trump’s second term, which could be an opportunity for Europe to catch up to the US.’

Less liquidity, more resilience

Venture capital companies such as Angelini Ventures want to close these gaps. Around

EUR 100 million of the EUR 300 million investment volume of the Angelini venture capital fund is currently invested. ‘Following their initial financing, we want to give companies the opportunity to conclude larger financing rounds within a diversified consortium in cooperation with larger and smaller players,’ says Hodits, explaining the strategic concept of Angelini. As for Europe, she stresses one big point compared with competitors from the USA and Asia: ‘For decades, European companies have been familiar with using their limited financial resources in an extremely capital-efficient manner. In the current market phase, where less money is available, this is a clear advantage.’

Few big deals, high valuations

In general, the European venture capital market is currently tending towards a division into smaller local fund companies and a few large venture capital funds, with the latter facing the challenge of supporting their portfolio companies for longer considering the currently limited exit options. ‘Occasionally, clinical development steps have to be financed for a longer period than originally planned,’ explains Hodits – and she recognises an upside to this trend: ‘In the case of success, this results in a bigger upside potential for venture capital companies than an exit at an earlier stage.’ At the same time, Hubert Birner, Managing Partner at TVM Capital Life Science, warns against ‘cluster risks’ as possible results from this market trend: ‘The money is currently concentrated around a small number of syndicates and attractive companies. Big deals in the region of EUR 50 million to 60 million can also occur in early-stage financing rounds. The resulting higher valuations

are passed on to the existing investors in the next rounds.’ In Birner’s view, these transactions reduce the potential of risk diversification for pension funds and insurance companies as venture capital fund investors. At the same time, rapidly rising company valuations increase the tendency in later financing rounds that most investors will stick around in the hope of a lucrative exit, with only a few new investors joining them.

Cluster investments and local heroes

Venture capital veteran Birner describes the investment strategy of TVM as ‘50% like the others, 50% completely different.’ In practice, this means that he and his team take part in some of these ‘cluster deals’ with companies whose products are just about ready for the market. In addition, TVM Capital invests in projects with only one or two other investors. These deals target companies that primarily develop one product to proof-of-concept and thus become takeover targets. TVM acts as the major shareholder. According to Birner, the prospect of lucrative exits attracts other investors for investing in TVM funds. ‘In our portfolio companies, they invest EUR 25 million to 30 million until the proof of concept. In the meantime, they can receive six to ten times that amount in returns via milestone payments. This doesn’t always happen, but it is a realistic target for our investments.’

Strong local returns through strategic co-investment

NRW.Bank is one of the German development banks which are involved as a local player in larger consortia. Raueiser’s team manages life sciences investments in a EUR 150 million venture capital fund. NRW.Bank participates in larger seed rounds and series A financings with volumes of EUR 5 million to 15 million. In exceptional cases, it also contributes with tranches of EUR 15 million to 20 million, in this case also for series B financing rounds. Raueiser illustrates using the example of Emergence Therapeutics how investments in local companies can bear high exit returns. The Duisburg-based start-up, which specialises in a new anti-drug conjugate (ADC) approach for cancer therapy, secured EUR 87 million in a series A financing round in December 2021. At the time, this transaction was the second largest series A transaction in Germany. Together with High-Tech Gründerfonds (HTGF) and Gründerfonds Ruhr, NRW.Bank was one of the consortium’s largest German investors. In June 2023, the US pharma company Eli Lilly acquired Emergence Therapeutics for an estimated USD 350 million.

M&A – The currently preffered exit option

Most industry experts agree that M&A will remain the preferred exit option in the foreseeable future. TVM expert Birner is convinced that many companies will not be able to realise their planned future financings through IPOs: ‘For this reason, we will see a significant increase in takeover activity in Europe over the next 18 months on a selective basis on both the pharma and medtech side.’ In Germany, the recently cancelled IPO of the Munich-based medtech specialist Brainlab has shown that companies from the healthcare sector are still struggling to realise an IPO at their desired valuations.

Nasdaq Stockholm as IPO platform

Within Europe, Nasdaq Stockholm has established itself as one stock exchange for the sector with a large number of IPOs. 119 companies, the vast majority of them from Scandinavia, have conducted their IPO on Nasdaq Stockholm since 2014. Nasdaq Stockholm emphasises lower listing fees and lower regulatory requirements than its New York counterpart. ‘Many European companies are considering an IPO on the Nasdaq in New York to address the large universe of life science investors there,’ says Adam Kostyál, Managing Director of Nasdaq Stockholm. ‘Maybe starting the journey here in Europe and then doing a double listing in a more mature stage of development might be a better option.’

Outlook

Whether choosing the IPO or the M&A path – it remains crucial for European companies to establish a broad local financial base at an early stage while at the same time already contacting international venture capital players to secure their support as lead investors for the bigger investment tickets in the future. Beyond that, collaboration and marketing deals with pharmaceutical and biotech companies are door openers for companies to bring their own products from the proof-of-concept stage to commercial market maturity. Finally, the management’s talent in selling the USPs internationally will be the icing on the cake for a well-financed success story which bears high returns for the company and its investors.